About australia copyright

About australia copyright

Blog Article

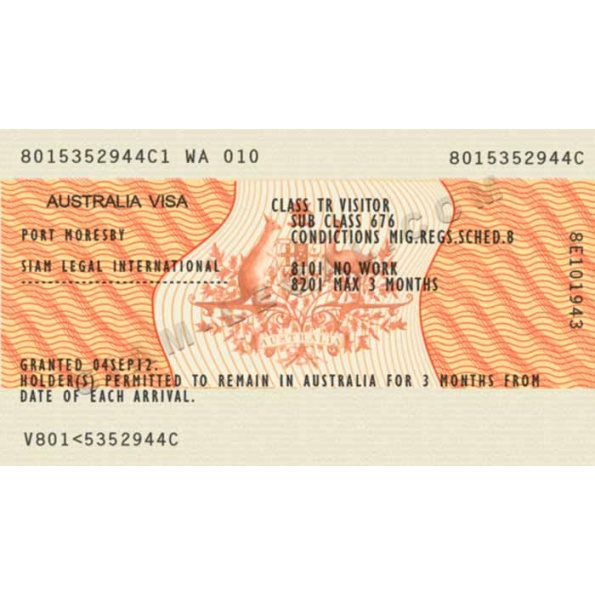

Website about Australia. Study appealing content about Australian visa along with other interesting info concerning this gorgeous country.

Superannuation: Australia has a compulsory superannuation procedure, where businesses add a percentage of your salary to some retirement discounts account.

Valid copyright: Should be from an suitable nation and legitimate for a minimum of 6 months in the day of entry into Australia.

Factors to return - You needs to have powerful ties in your home region that will make certain that you'll return just after your stay.

They also have a brilliant going to Australia book that covers everything you have to know before you make the go! :

Paying out copyright service fees: Visa applications incur fees, which differ depending upon the visa category.

You have to be competitive in English, that is an equivalent test consequence with a minimum of six in Every single band.

Action six: Watch for acceptance letter and visa about The moment your application is submitted, wait for the admission determination. If you get a suggestion letter, you have to shell out the tuition deposit to get your Affirmation of Enrolment (CoE).

If you really feel overwhelmed or dropped, Yocket High quality is at your assistance! The industry experts may help you Get the proper documents in the proper timeframe, smoothing your entire pupil visa course of action for you.

Our Australian working holiday visa course of action was Tremendous easy. about Moving from Ireland, the application procedure virtually will take minutes answering a handful of queries in excess of the mobile phone.

Competencies assessment - before you implement, you must have your techniques assessed because of the Australian evaluating authority designated to evaluate your nominated profession (which will usually have particular skills requirements);

These figures stand for a wide variety, with distinct costs with regards to the College and the training course.

Additional provisions apply for select degrees and skills, extending eligibility by up to two years.

The tax 12 months in Australia runs from July 1 to Jun thirty. If you're employed in Australia, the tax is going to be withheld out of your spend, and you will have to lodge a tax return every year.